How Affiliate Marketers Can Unlock Growth with Business Funding

Affiliate marketing remains one of the fastest-growing online business models, providing marketers with the opportunity to generate substantial revenue through partnerships and commissions. However, scaling an affiliate marketing business often requires investment in tools, advertising, and talent, and that’s where securing the right business funding becomes essential.

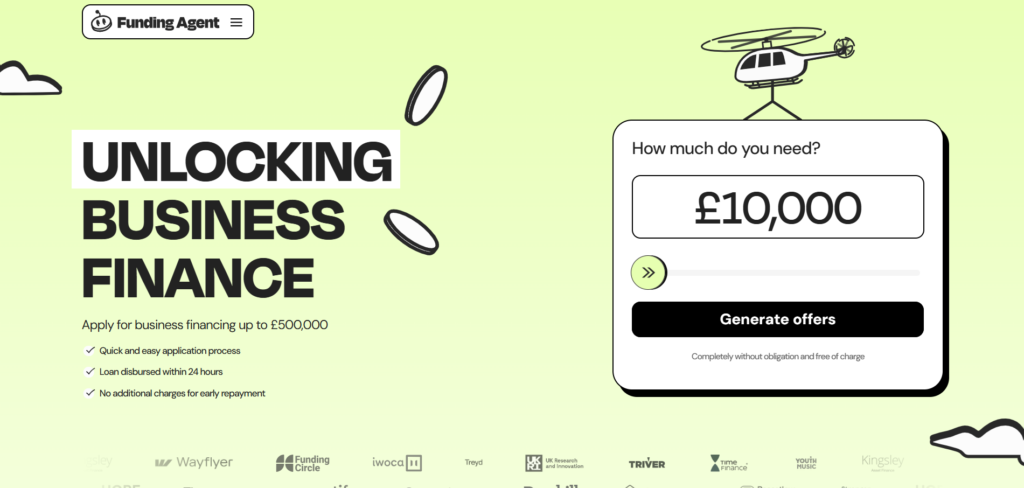

That’s why we want to introduce you to Funding Agent, a specialist consultancy that helps businesses like affiliate marketers access the finance they need to grow and compete more effectively.

Why Affiliate Marketers Should Consider Business Funding

Successful affiliate marketing goes beyond creating content and driving traffic. To truly expand your operations, you may need to invest in paid campaigns, software platforms, or even additional staff. These investments require capital, and many affiliate marketers find that securing external funding accelerates their growth, enabling them to increase reach and revenue faster.

The Funding Options Available for Affiliate Marketers

There are several funding routes affiliate marketers can explore, such as:

- Business loans for flexible capital to invest in marketing or infrastructure (consider options like unsecured business loans).

- Invoice finance to improve cash flow if you work with clients or networks on invoiced payments.

- Equity funding from investors for those with larger-scale ambitions.

- Government grants that may be available to eligible digital businesses.

Understanding which option suits your particular situation can be complex. This is where Funding Agent’s expert guidance becomes invaluable, helping you navigate the choices and application processes. You can even use their business loan calculator or invoice finance calculator to get an estimate.

How Funding Agent Supports Affiliate Businesses

Funding Agent takes a personalised approach to funding, working closely with businesses to build tailored strategies that simplify applications and improve approval chances. They specialise in supporting a wide range of businesses, including digital and marketing companies, making them well placed to assist affiliate marketers specifically.

By partnering with Funding Agent, you gain access to:

- Expert advice on the best financing options for your business.

- Assistance in preparing and submitting applications.

- A smoother, less stressful funding process.

You can find out more about their services on their homepage.

Tips for Affiliate Marketers Seeking Funding

If you’re considering applying for funding, keep these practical tips in mind:

- Keep detailed and organised financial records.

- Prepare a clear business plan that outlines growth plans and funding usage.

- Be realistic about your funding needs and repayment capability.

- Consider working with a specialist like Funding Agent to maximise your success.

Ready to Take Your Affiliate Marketing Business Further?

If you’re looking to scale your affiliate marketing operations with the right funding, we recommend reaching out to Funding Agent. Their expertise can help you unlock the capital needed to grow confidently and sustainably. Please fill out their online form to get started!

Frequently Asked Questions

Why would an affiliate marketer need business funding?

Affiliate marketers often need funding to scale their operations. This includes investments in paid advertising campaigns, advanced software platforms, tools, and even hiring additional staff to expand reach and revenue more quickly than organic growth alone allows.

What types of funding options are available for affiliate marketers?

Affiliate marketers can explore various funding routes, including traditional business loans for general capital, invoice finance if they work with clients or networks on invoiced payments to improve cash flow, equity funding for large-scale ambitions from investors, and potentially government grants for eligible digital businesses.

How can Funding Agent specifically help my affiliate marketing business?

Funding Agent offers personalised guidance, helping you identify the most suitable funding solutions for your specific business needs. They assist with preparing and submitting applications, streamlining the entire funding process to make it less stressful and improve your chances of approval.

What should I prepare before applying for funding as an affiliate marketer?

Before applying, it’s crucial to have detailed and organised financial records. You should also prepare a clear business plan outlining your growth objectives and how the funding will be utilised. Be realistic about your funding needs and your capacity for repayment.

- Is Affiliate Marketing Still Worth It in 2026? The Data-Driven Answer - 25 January 2026

- Affiliate Marketing in 2026: The Data Behind a $17 Billion Industry - 25 January 2026

- 247Partners Launches Dragonia: Are You Ready for Dragonic Wins? - 27 November 2025